It took the break of the JPY100 level to trigger a broad based US

dollar rally on Friday. This rally lifted the dollar's technical tone

and suggests additional gains are likely. However, the out-sized gains

ahead of the weekend warn of the risk of a consolidative phase first.

After

trying for nearly a month, the market finally pushed the dollar through

the JPY100 level and the up move accelerated to almost JPY102 within 24

hours. The triangle or wedge pattern that has been convincingly broken

projects into the JPY104-JPY105 area. Pullbacks toward JPY100.70 will

likely be seen as a new buying opportunity.

There has been a

significant backing up of US interest rates. The 10-year yield has risen

near 30 bp since the start of the month, and is nearing the upper end

of this year's range. The rise in US rates follows a decline from

mid-March through late-April that had taken the 10-year yield from 2.08%

to almost 1.60% We find that the dollar is often sensitive to interest

rate differentials. The sharp backing of US rates has more than offset

the sell-off in the Japan's 10-year government bond and this has lifted

the Treasury premium over Japan to its widest level in a month.

On

the other hand, we find the euro-dollar exchange rate often tracks the

US-German 2-year interest rate differential. Even though the

euro

slipped to new four week lows before the weekend, the premium the US

offered over Germany was near the lower end of the range that has

confined it since early April. This disconnect also supports the case

for a consolidative phase. During this period, a euro bounce into the

$1.3030-60 area may offer a new selling opportunity. In the bigger

picture, we look for the euro to retest the year's low near $1.2750 in

the second half of Q2.

The

Swiss franc appears to be

selling off in sympathy with the Japanese yen, or perhaps in part driven

by similar forces. Swiss 2- and 3-year interest rates remain negative,

and in the quest for yield the franc is shunned. This leaves the euro to

retest the year's high near CHF1.2570, which is also the highest it has

been since the SNB imposed a cap on the franc (floor for the euro). A

move above there will fan expectations for CHF1.30.

Sterling's

breakdown through a 2-month uptrend on an intraday basis warns that the

$1.56 area, which has been repeatedly tested with little satisfaction,

marks a more significant top. At the same time, the fact that sterling

closed above the trend line is consistent with our sense that a period

of consolidation, at least in the early part of the new week, is likely.

During this phase, sterling can recover toward $1.5420-50.

The weakest currency over the past week was not the Japanese yen, but the

Australian dollar.

It lost about 3% compared to the yen's 2.6% decline. The Australian

dollar traded below $1.00 for the first time since last June. It too

managed to finish barely above there before the weekend. The technical

bounce we expected early in the new week to alleviate the over-extended

technical condition could see the Aussie trade toward $1.0070-$1.0100.

After the correction, we look for the Aussie to test the trend line

drawn off the 2011 and 2012 lows. It comes in near $0.9800 now and

$0.9850 by the end of the quarter.

The

Canadian dollar,

like nearly every other major and emerging market currency, was sold off

hard at the end of last week. Like the UK, Canada also reported

constructive data, and like sterling, the Canadian dollar found little

succor from the news stream. The US dollar's rally against the Loonie

ran out of steam near important technical levels in the CAD1.0150-70

area. A move above there warns of scope for another cent gain toward

CAD1.0250, but we are more inclined to see downside consolidation back

into the CAD1.0060-80 area.

Fitch's upgrade of

Mexico's

credit rating pushed the dollar below MXN12.00 for the first time since

2011, which itself was the first time since 2008. The 2001 dollar's low

took the form of a double bottom and was carved out of many weeks around

MXN11.45. That said, the dollar recovery in the second half of last

week created bullish (dollar) divergences in some technical indicators.

Not only was the break of MXN12.00 not sustained on a weekly basis, but

the divergence warns that more backing and filling may be necessary

before a sustained break materializes. This also is consistent with more

talk of another rate cut following disappointing industrial production

figures (-0.3% in March rather than -0.1% the consensus forecast) before

the weekend.

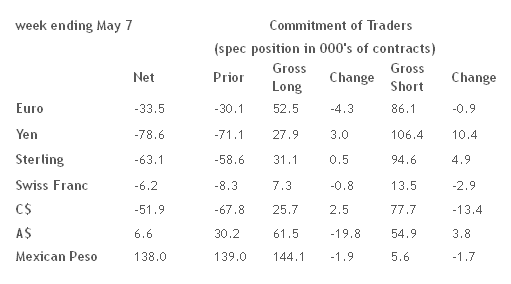

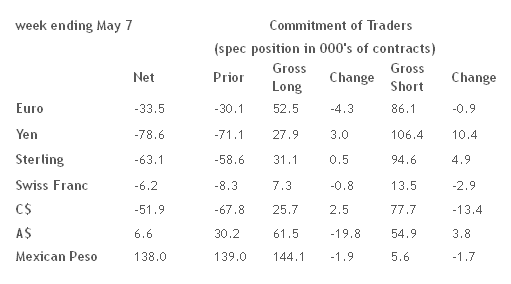

Observations from the CME speculative currency positioning:

1.

The gross short yen positions increased by 10.4k in the week ending May

7. This is consistent with ideas that the speculators were anticipating

a breakout after the Golden Week holidays ended. Some cast

conspiratorial allusions to the fact that the dollar broke above JPY100

prior to news that Japanese investors had bought (a relatively small

amount) of foreign bonds in the past two weeks. Anticipation more than

malfeasance is the more likely explanation.

2. Gross short

Canadian dollar positions were culled by 13.4k contracts to a still high

77.7k. It was the third consecutive week of short cover covering after

peaking just shy of 100k in late-April. During this short-covering the

US dollar fell from near CAD1.03 to almost CAD1.00. The sell-off in the

Canadian dollar after the CFTC reporting period suggests the

short-covering may have stalled.

3. The long Australian dollar

positions fell by almost 20k contracts, leaving a mere 6.6k still

standing. This is the smallest gross long position since mid-2010. It

had peaked in late March near 141k contracts. The Australian dollar's

further sell-off into the weekend, widely publicized bearish comments by

a high profile hedge fund manager, and poor (piling on?) press, warns

that the net speculative position may have switched to the short side.

4.

The net speculative euro position has hardly moved in recent weeks. The

net position has been short between 30k and 34k contracts for four

weeks. Over this time, the euro has largely been confined to a

$1.30-$1.32 trading range.